News

Market & Economic Update — Insights from Michelle Perkins, Craigs Investment Partners

We recently hosted an excellent presentation from Michelle Perkins, Director of Wealth Research at Craigs Investment Partners, who shared her insights on what’s driving global and local markets right now. For those who couldn’t make it, here’s a short…

FREE SEMINAR: An Economic Update with Craigs Investment Partners

Join us for a complimentary morning tea as we hear from Craigs Director of Wealth Research, Michelle Perkins, on the current economic outlook and the implications for markets. There will be time after the presentation for questions and networking with…

Trusts and Blended Families – Protecting Your Assets

Blended families are increasingly common in New Zealand, and with them comes a rise in complex trust and relationship property issues. We are seeing more situations where a new partner gains access to a trust they have not contributed to at all. Without…

The Investment Boost & What it Means for Your Business

Following Nicola Willis’s Budget announcement on 22 May 2025, several key initiatives stood out—one of the most talked-about being the Investment Boost. This new scheme has raised several questions around how it works and what it means for different…

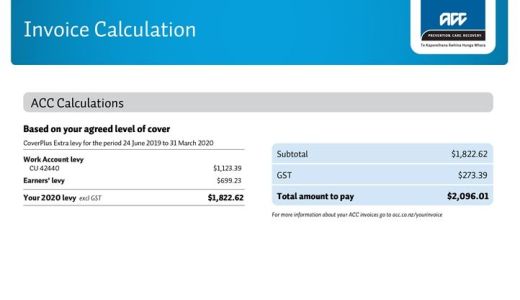

ACC CoverPlus Extra (CPX) - What Business Owners Need to Know

Running a business comes with enough challenges—your ACC cover shouldn't be one of them. If you're a self-employed business owner or contractor, you've probably heard about ACC CoverPlus. But have you heard about ACC CoverPlus Extra (CPX)?

What You Need to Know About Commercial Leases in New Zealand

If you’re a business owner leasing commercial premises in New Zealand, it’s important to understand what’s in your lease agreement. From who’s fixing the roof to how rent gets reviewed, there are a bunch of key terms that can affect your bottom line.…

Essential Cash Flow Tips for Small Business Owners

Cash flow is the lifeblood of any business. Even a profitable company can struggle if it doesn’t have enough cash on hand to cover expenses. For small businesses in New Zealand, effective cash flow management is critical, especially during challenging…

Navigating Financial Hardship as a Small Business Owner

Running a small business comes with its fair share of ups and downs. Financial hardship can arise from economic downturns, unexpected expenses, or changes in customer demand. Here’s a practical guide to help you navigate financial challenges and keep your…

Five Ways to Boost Your Income During the Post-Holiday Slowdown

While industries like tourism and hospitality flourish in the summer, many businesses face a drop in activity after Christmas and New Year’s. Does this sound like your situation? If so, don’t worry. Here are five effective strategies to maintain your cash…

Understanding Farm Accounting - Deductions and Tax Implications

Farm accounting is a specialized area of tax, and it’s crucial for farmers to understand the deductions and tax implications that can apply to their operations. From the cost of developing the farm to managing livestock and vehicle expenses, proper…

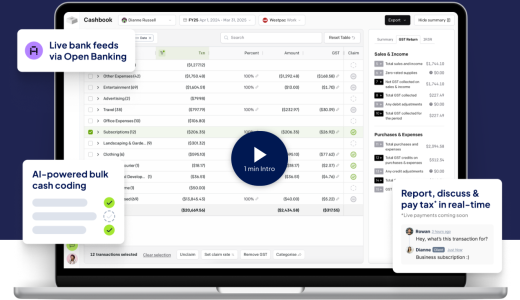

Can AI help you speed up returns and lower your tax bill?

We get it: getting your financial data organised for your accountant can be a headache. It takes time away from your business, and can delay getting your tax return sorted. At Real CA, we understand how valuable your time is, and that's why we're excited…

The Importance of Supplying Your IRD Number for Interest and Dividends

It's important to keep your financial matters in order. One crucial aspect is ensuring that your IRD number is supplied to all entities from which you receive interest or dividends. This small but vital step can significantly impact the efficiency of…

Rob Egan Receives Prestigious CAANZ Fellowship Award

We are proud to announce that our managing director, Rob Egan, has been awarded the esteemed CAANZ Fellowship Award. This prestigious honour recognizes Rob's outstanding career achievements and his significant contributions to the business community, the…

Getting Organised for the New Financial Year

Now is a good time to think about gathering the records together that your Client Manager will require to prepare your accounts. Ensuring that your records are complete can reduce the amount of time we spend preparing your accounts. It is going to be lot…

Consent Phishing: The Emerging Phishing Technique That Can Bypass 2FA

Consent phishing is an emerging technique attackers are using to compromise user accounts, even if they have Multi-factor Authentication (MFA or 2FA) enabled. Consent phishing is particularly effective because it doesn’t exhibit many of the indicators…

How Job Management Software Can Help You Grow Your Business

For businesses in the field service industry, an efficient job management process is the foundation that leads to ongoing success and growth potential. At its core, good job management is about the efficiency of processes and workflows that your business…

Residential Land Sales - Getting you up-to-speed on the Bright-line Rules

REAL Chartered Accountants and Business Advisors are updating clients on changes to the bright-line rules which came into effect on the 1st of October 2015. Inland Revenue has advised that residential land sales will be a compliance focus in 2021.

Fully Funded Business Support Services Announced

We are proud to announce that as an approved service provider of the Regional Business Partner Network (an NZTE initiative), we are now able to offer two fully funded chartered accounting and business advisory services to help your business through this…

Maintaining Staff Engagement During Covid-19

One of the top engagement drivers for employees is seeing their work contribute to company goals. Businesses need to focus on employees’ emotions related to the coronavirus pandemic to restore productivity and belief in the business being able to achieve…

XAP - Xero Assistance Programme Pilot Extended

There’s a growing need for mental health support for small businesses in New Zealand as shown from the results of the Xerio 2019 Small Business Wellbeing Report. As a result, Xerio has recently announced it will be extending the Xero Assistance Programme…

A lot learned from REAL Chartered Accountants Trusts Seminar

Mike Dorset from JR Legal joined the REAL Chartered Accountants team to share his knowledge and advice on Trusts as well as updating us on the new Trust Act 2019. We've outlined a quick summary of the key out-takes from his seminar here...

Bed tax would put Kiwis out of pocket, says tourism body

The prospect of a bed tax is polarising the tourism industry, despite both sides acknowledging local authorities need more support. The Productivity Commission's draft report found councils under pressure from tourism should be able to charge visitors…

Accountant warns accidental tax refund will likely have to be paid back

[As published by NZ Herald, 29-April] An accountant is warning people to be wary if they received an "accidental tax refund" over the Easter/ Anzac holiday period and says it is likely the money will have to be paid back to the tax department. Jason…

WORKSHOP ANNOUNCEMENT: New Tax Rules for Landlords

We are pleased to announce leading tax advisor, Graeme Curruthers of NSA Tax, will be our guest speaker and presenter for our upcoming workshop on the new tax rules for landlords. If you own a rental property or rent out your holiday home then this…

Welcome to Rose - Our Customer Services Assistant

Many of you will have already met Rose or spoken with her on the phone. Having joined our team in May as our Client Services Assistant, Rose works at our front desk supporting both our clients and accounting team with a wide range of administrative tasks.…

Congratulations to Our Award Winning Business Owners!

We are very fortunate to work with many highly motivated, passionate business owners some of whom were recognised for their talent and successes at regional business awards events this year. A special congratulations to the team at Little Big Events and V…

How to Maximize your Assets before Retirement with Tactical Investing

Risk tolerance, time horizon, and asset allocation – you’ve dealt with these factors for a good part of your life, but now, in the face of retirement, they take on a more urgent and significant role. These factors – particularly tactical asset allocation…

Childcare in NZ more costly than most of the world

Childcare in New Zealand is more expensive than almost every other country in the western world. The OECD says Kiwi families are spending almost a third of their household income on childcare. The only county ahead of us on the list is the UK, where…